Global stocks simultaneously peaked and increased dramatically after Jensen Huang’s Nvidia Group reported huge profits thanks to the wave of AI technology, surpassing even Elon Musk’s Tesla. But, risks appear from the signals of “Wall Street foxes”.

US and Japanese stocks peaked

Never before have stocks broken out as strongly as they are today, the world’s largest markets simultaneously reached historic peaks even though the world economy is still covered in gray amid concerns of recession and crisis.

The biggest technology wave ever, represented by Nvidia Corporation – the tycoon that accounts for 80% of the world’s high-end AI chip market, has blown a fiery fire into financial markets, pulling up stock prices. across global markets went up.

At the end of the trading session on February 22 (early morning of February 23 Vietnam time), the US Dow Jones industrial index exceeded the threshold of 39,000 points for the first time. The broad index S&P 500 increased 2% and set a new record. The Nasdaq Composite technology index even increased nearly 3% to 16,042 points, only about 15 points lower than the all-time record.

Previously, in the trading session of February 22, the Japanese stock market had a rare breakthrough. The Nikkei 225 index surpassed 39,000 points for the first time and reached an all-time high. Japanese stocks increased sharply even though the country just announced that the economy will enter recession in the last quarter of 2023. Japan lost its position as the third largest economy in the world to Germany due to weak consumption.

Investors expect a brighter situation for Japanese businesses along with governance reforms from the government. The Nikkei 225 and Topix indexes have both increased more than 10% since the beginning of the year.

Many other stock markets around the world also increased dramatically. Cash flow suddenly returned, no longer afraid to be defensive right after US technology giant Nvidia announced quarterly business results much better than forecast. The fever for global investors when the AI trend becomes clearer than ever, thereby promoting the market and technology sector.

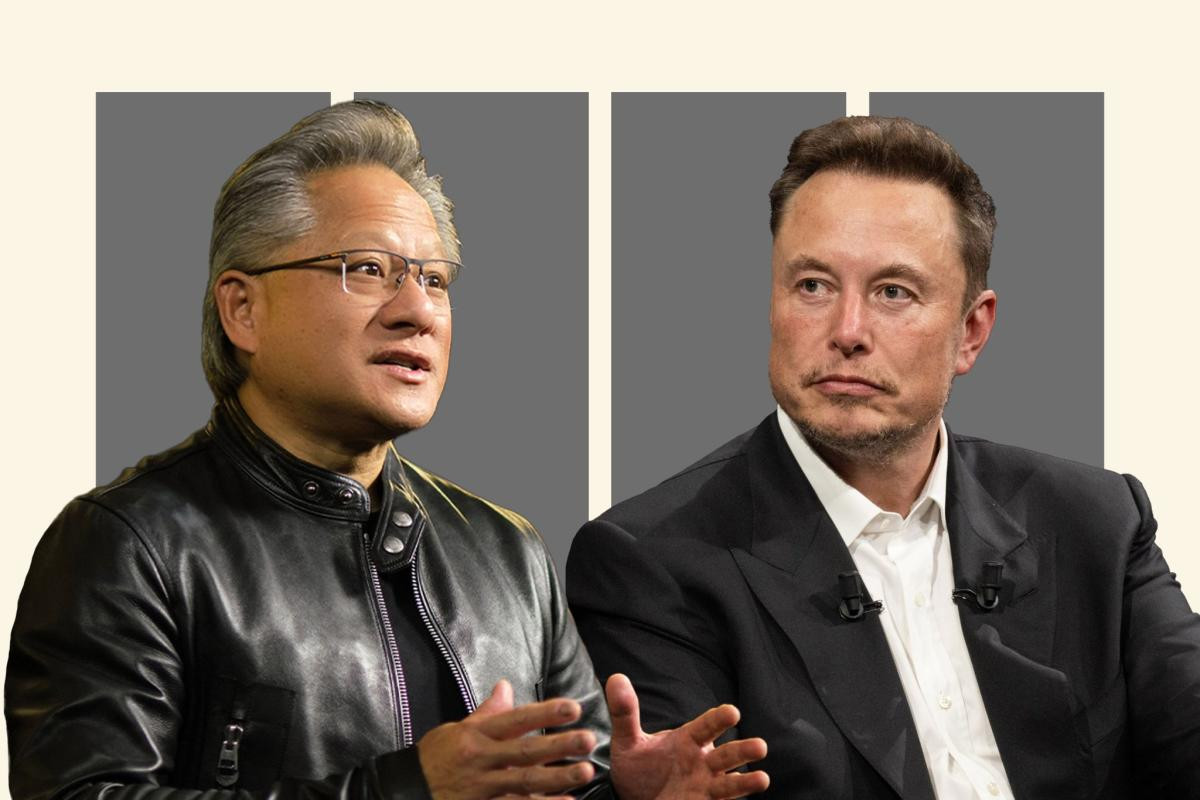

Nvidia shares immediately increased 16.4% to a historic high after the company of Chairman and General Director Jensen Huang (who just came to Vietnam at the end of 2023) reported that 2023 revenue had jumped 265% compared to compared to the previous year thanks to the booming artificial intelligence business.

Nvidia’s capitalization skyrocketed to 1,940 billion USD and firmly ranked 3rd in the world, behind Microsoft and Apple, far surpassing Tesla (619 billion USD) of the world’s 2nd richest technology billionaire Elon Musk.

In recent sessions, Nvidia has surpassed Tesla to become the most traded stock in the US market, with about 30 billion USD/day.

Nvidia President and CEO Jensen Huang. Photo: The Telegraph

Investor excitement over the AI wave that has lasted since last year has helped the global stock market break out, instead of falling.

Previously, many forecasts said that if Nvidia reported business results that were not as expected, global technology stocks would plummet; Nivida shares, after increasing 40% from the beginning of the year to the end of February 21, will turn around. However, the reality was the opposite.

Hotter than ever, is there a bubble in global stocks?

Although global stocks, including those in the US and Japan, soared to historic peaks, many recent warnings said that expectations were too high. In the US, interest rates are still at the highest level in more than 2 decades, businesses and people will still suffer many negative impacts. Although the US economy may not witness a crisis, there is still a risk of a slight recession.

Meanwhile, in Japan the situation is quite tragic. This economy has been on a downward slide for many years, recording a decline in GDP growth of 0.4% in the fourth quarter of 2023 after a 3.3% decline in the third quarter.

Japan is still maintaining a negative interest rate policy and it is difficult to push the economy to recover quickly. The country’s Yen has dropped in value and is currently above 150 Yen for 1 USD, instead of 130 Yen for 1 USD about a year ago.

Currently, investors expect the Bank of Japan (BOJ) to end its negative interest rate policy in April.

On CNBC, Phillip Colmar of MRB Partners noted that US stocks are benefiting from profit growth and stronger economic activity than forecast. However, Mr. Colmar said stocks could still fall if economic growth ends up being priced into rising bond yields.

According to the latest report, in the fourth quarter of 2023, Bill Gates’ fund sold all the stocks of the world’s technology giants, including: Apple, Meta, Amazon, Nvidia and dozens of other companies such as Morgan Stanley, Johnson & Johnson, Unilever, Home Depot, Goldman Sachs…

The Bill & Melinda Gates Foundation Trust also continuously sells off Berkshire Hathaway shares of world stock investment tycoon Warren Buffett.

The anomaly of many stock markets around the world, including the US, began in 2023 when stock prices continued to increase even though interest rates and bond yields were at record highs for many decades. Investors ignore the impact of high interest rates.

Covered globally, IPO activities are in a difficult position and the real estate market is sluggish, people’s income and consumption are declining…

However, many stock markets still increased strongly thanks to artificial intelligence (AI), surprising many people. US stocks are currently more expensive than at any time since the dotcom bubble burst.

Recently, many giant American technology corporations have brought huge profits and are believed to be the best places for investment. New inventions and investments in AI are largely uncommercialized and future profits are uncertain. However, the AI fever is leading money to pour heavily into technology stocks.

In Vietnam, FPT technology stocks also increased strongly and are at a historic peak.

The AI trend fever is still rising. Nvidia CEO Jensen Huang has allayed concerns from investors after posting strong revenue and profits in the fourth quarter. Mr. Huang also said that conditions for continued growth “in the near future remain very good.”

CEO Jensen Huang at the end of 2023 visited Vietnam and talked about the opportunity for Vietnam to catch the biggest technology wave ever, especially after the US and Vietnam upgraded their relationship to a war level. comprehensive strategy.

According to Mr. Huang, the new wave is very big, fast and “unlike any previous industrial revolution”. After only 1 year, the concept of AI has covered the world.

Nvidia is a multinational technology company that designs graphics processing units (GPUs), application programming interfaces (APIs) for data science and high-performance computing, and systems on mobile devices. unit of chip (SoC) for the mobile and automotive computing markets. This group has a market capitalization nearly 5 times greater than Vietnam’s GDP.